Expansive developments with large, low-density footprints, like a sprawling subdivision, are typically more expensive to service with public utilities like streets, water, and sewer. Thus, examining a development’s total tax production overlooks the amount of land and other public resources consumed in order to produce revenue. Nevertheless, many cities use a total value map, like the one above of Wyandotte County, to inform land-use decisions.

To gauge the fiscal implications of vacancy we’ll look at a neighborhood with a heavy concentration of vacant and delinquent parcels. There are 732 vacant lots in the area shown. Collectively they are appraised at just $293,000. It’s worth mentioning that they currently produce no tax revenue as they are held by a land bank. The lots with houses in this neighborhood have dramatically undervalued or suppressed appraised values. The average parcel is valued at just $17,000. Despite this low value its still 40 times greater than a vacant lot.

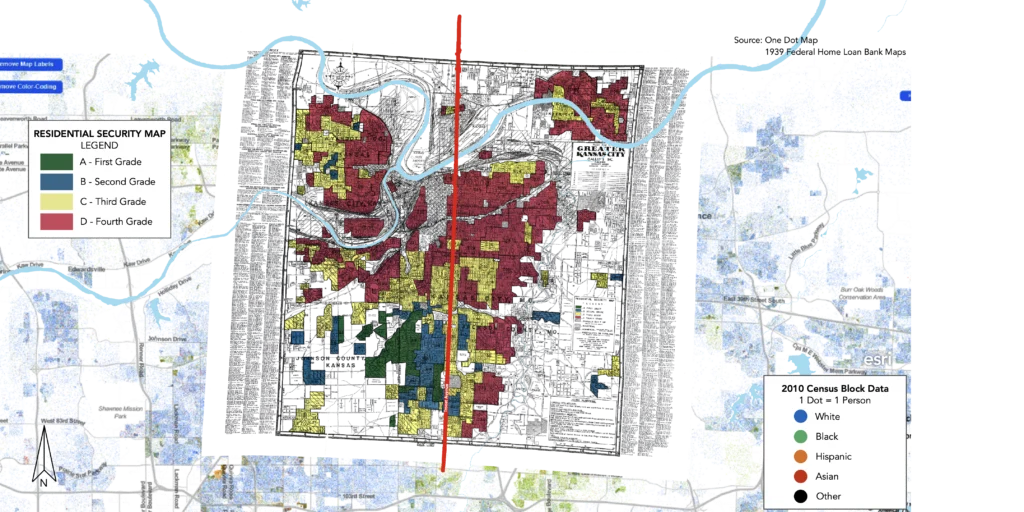

A history of redlining affects the monetary value of properties. The map to the left shows today’s parcels color-coded by the redlining map classifications and extruded in height by their current value per acre. Overall, red areas have a lower value per acre than yellow areas.

The image to the left highlights the disparity in today’s value amongst neighborhoods that were marked with different levels of financial risk in 1939. What is visually clear, in terms of parcel height, becomes concrete when we examine the average value per acre. The average value per acre ranges from $541k per acre in a red neighborhood to more than $5m per acre in a blue neighborhood. Again, the exception is the primary corridor of Minnesota Avenue. These patterns demonstrate that the impact of redlining has either positively protected and boosted property value in some neighborhoods while suppressing and reducing value in others. Understanding this history is vital to reconciling this wealth and racial disparity.

Outcomes

- Walkability, good design, and historic buildings all increase tax productivity.

- Incentive programs are a tool. They can be used well or poorly. Decisions on future incentives should be based off of comprehensive data.

- Caution should be taken with greenfield development. It is profitable, but it requires new infrastructure while existing infrastructure closer to the City goes unused.